deals with emerging challenges to encourage forward thinking strategies

gains valuable insight into the latest thinking in diverse fields of managing disability and encourages stimulating interchange of ideas

Through rigorous research and analysis, Dialogue provides insight into emerging challenges and an opportunity for forward thinking strategies to address the management of disability and related issues by encouraging open discussion with peers from around the world.

Insurtechs are both invigorating and redefining the delivery and servicing of insurance coverages by adopting emerging technologies such as bots. Administrative tasks in workers' compensation claims handling can account for approximately 40% of total claims costs which can be significantly reduced and yet provide a better service through the introduction of bots. With many third party administrators (TPAs) lagging behind in adopting emerging technologies, investors like eager punters placing a bet on their favorite horse are ready to invest in those insurtechs vying for a major share of the lucrative TPA market. The race is on.

The popularity of the 1993 Bill Murray movie rendered the phrase "Groundhog Day" with a common reference to a continually occurring unpleasant situation, according to Wikipedia.

Workers' Compensation claims handling seems to be stuck in a time warp with the same unpleasantries occurring over and over for the past 30 years or more. Is it time for a new breed of claims administrator to effect change and break through the Groundhog Day time warp?

The Patient Protection and Affordable Care Act or more commonly known as the Affordable Care Act ("ACA") or Obamacare has expanded the U.S. healthcare system to provide medical coverage for more Americans especially for those on low incomes. However, this has come at a price with President Trump vowing to repeal and replace the ACA. While the ACA is predominately funded by the federal government, population health to a large degree is influenced by state laws, whether relating to diseases or traumatic events. This article proposes reforms to two California social insurance programs covering traumatic events - workers' compensation and state disability insurance ("SDI"). It also includes process and technology advancements aimed at improving the quality of life for Californians.

The title of this article is "Could 500,000 California Employers Refuse to Purchase Compulsory Workers' Compensation Insurance Citing P&Cs' Bad Faith?"

A study using 2014 California data from the WCIRB identified that only 53 cents of each premium dollar was spent on employees' benefits of which only 18 cents was spent on providing medical treatment during employees' recovery periods. As an alternative to the P&Cs' insurance product, Oklahoma provides an "opt-out" product and South Carolina and Tennessee are considering a similar option. This article explores causes for the high administrative costs associated with the P&C product and looks at options for reining in this cost.

According to the Workers' Compensation Insurance Rating Bureau (WCIRB), injured workers in California received 53 cents in benefits for each $1 of premium in 2014, of which 18 cents was spent on treatment during the recovery period.

Their latest document released August 2, 2016 however, shows that in 2015 the figure has reduced from 53 cents to 51 cents in benefits for each $1 of premium, which may threaten P&Cs exclusivity in providing insurance coverage for the protection of the employer as well as their employees.

To maintain exclusivity, P&Cs may need to focus more closely on their claims management practices to reduce excessively high administrative costs.

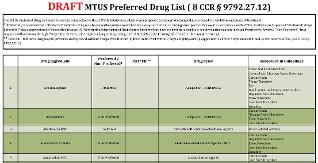

The draft California MTUS (Medical Treatment Utilization Schedule) Drug Formulary based on a drug's ingredient name differs from the Official Disability Guidelines (ODG) Drug Formulary produced by Work Loss Data Institute which is based on a National Drug Code (NDC) and used by states such as Texas.

The California approach directly addresses the intent of AB1124 introduced by Assembly-Member Henry T. Perea to reduce the risk of an injured worker becoming addicted to dangerous medications. This article looks at how a drug's generic product identifier (GPI) which Medi-Span provides is a significantly better option than using the NDC in both prior and pre-authorization processes in California workers’ compensation.

California workers' compensation law allows the filing of a lien against a claim in order to seek payment for services or benefits.

After 26 years, liens continue to be regarded as a major cost factor for the Property & Casualty (P&C) Workers' Compensation Insurance product and still remains a conundrum for legislators and regulators who want those that deserve payment to be treated fairly, yet fraudsters weeded out at the same time.

Although SB1160 (Senator Tony Mendoza [D-Artesial]) and AB1244 (Assemblyman Adam Gray [D-Merced]) may help in reducing both lien filings and costs, P&Cs and self-insured employers are primarily responsible for implementing procedures and operations including computer systems which can take maximum advantage of the bills' initiatives.

This article examines allegations against Dr. Janak K. Mehtani by the Executive Director of the Medical Board of California, relating to three patients receiving treatment through workers' compensation benefits.

On August 18, 2016, the Medical Board of California issued a Stipulated Settlement and Disciplinary Order for Dr. Mehtani who was placed on probation for three years with specific terms and conditions.

This article looks at findings from a California Workers' Compensation Institute ("CWCI") study to see whether a closed pharmaceutical formulary would be beneficial in further reducing pharmaceutical costs. It also looks at the goals established by AB1124, a Bill introduced by Assembly-Member Perea for the introduction of a closed formulary in California.

Pharmaceuticals remain a large component of the total medical cost in treating workers' compensation injuries and illnesses. On the positive side, the use of pharmaceuticals may decrease demand on other health resources, improve health outcomes and treatment safety, all enabling people to return to work. On the negative side, effort needs to be devoted to monitoring and controlling pharmaceutical prices. This begins with capturing pharmaceutical data at the most granular level, in the case of pharmaceuticals in the United States this involves the National Drug Code ("NDC").

Prescription Drug Monitoring Programs ("PDMP") can assist physicians in deciding on medications to be prescribed for the injured worker. PDMPs alone cannot achieve optimum results but used in conjunction with the Claims Administrators own encounter data such as ICD-10 codes, HCPCS and NDCs can consistently yield the best claims outcomes. These include earlier return to work, lower costs associated with medical treatment through to automated overseeing of a claim including provider performance monitoring and evaluation all of which form the essence of superior workers' compensation claims management. Claims administration costs accounted for 30% of total costs in 2014 for the California P&Cs' workers' compensation insurance product. Similar costs experienced in other states have prompted employers to move states as reported by Illinois Governor Bruce Rauner. The Governor cited an Illinois employer leaving the state and moving15 miles to a location in Indiana to save $1 million in workers' compensation premium.

A Workers' Compensation Research Institute ("WCRI") study titled "Are Physician Dispensing Reforms Sustainable?" prompted Michael Gavin, President of PRIUM, a subsidiary of Ameritox to author an article titled "Physician Dispensing: I've changed my Mind". In addition, the WCRI study prompted Ramona Tanabe, Executive Vice President and Counsel of the Workers' Compensation Research Institute to author an article titled "Loophole for Doctors on drug Dispensing". This article reviews the muscle relaxer medication Cyclobenzaprine described in the WCRI study and highlights the need for an understanding of the differences between the various suppliers of pharmaceuticals in the United States, otherwise, studies may be misinterpreted.

This article looks at how technology can monitor the cost of pharmaceuticals ensuring overpayments, which can unnecessarily increase employers' premiums , do not occur.

Physician dispensing of medications and repackagers may not be the only cost drivers causing the high pharmaceutical costs in U.S. workers' compensation. This article looks at the price variations between manufacturers and distributors and identifies large variations in prices for some of the most common drugs dispensed in treating workers' compensation injuries/illnesses.

While most of Europe, the United Kingdom and Australia provide national healthcare through some form of social welfare, the U.S, in contrast, provides healthcare through the private sector. This article also identifies that competition between manufacturers, distributors and repackagers in the U.S. can indeed create significant savings when purchasing pharmaceuticals which in turn reigns in overall pharmaceutical costs.

This article describes the various tools and processes that are used in controlling pain which when used efficiently, can produce the very best outcome for the person involved. Pain threshold and tolerance is different for everyone and the medications which are available vary greatly. Maximum relief with tolerable side effects is in essence what all those suffering hope for. Claims administrators need to be prudent in their assessments and decision-making, using all resources available to focus on the appropriate medical treatment to accelerate health and return to work. Challenges arise however with the "ethical dilemma" when financial incentives are at the top of the decision-making process instead of the welfare of the individual being the most important factor.